In the United States, there is a disparity in the tax contributions of billionaires and ordinary Americans. While the wealthy pay a minimal portion of their wealth in taxes, middle-class citizens contribute a substantial share of their hard-earned wages. President Joe Biden has taken a bold step to address this long-standing issue with his newly exposed budget proposal for fiscal year 2025.

On March 11, the Biden Administration presented its comprehensive budget plan, aiming to boost revenues and reduce spending by $4.3 trillion over the next decade.

This ambitious plan seeks to counterbalance other spending increases, resulting in a net deficit reduction of $3.2 trillion over the decade. The proposal’s most well-known aspects involve tax hikes for corporations and high-income taxpayers.

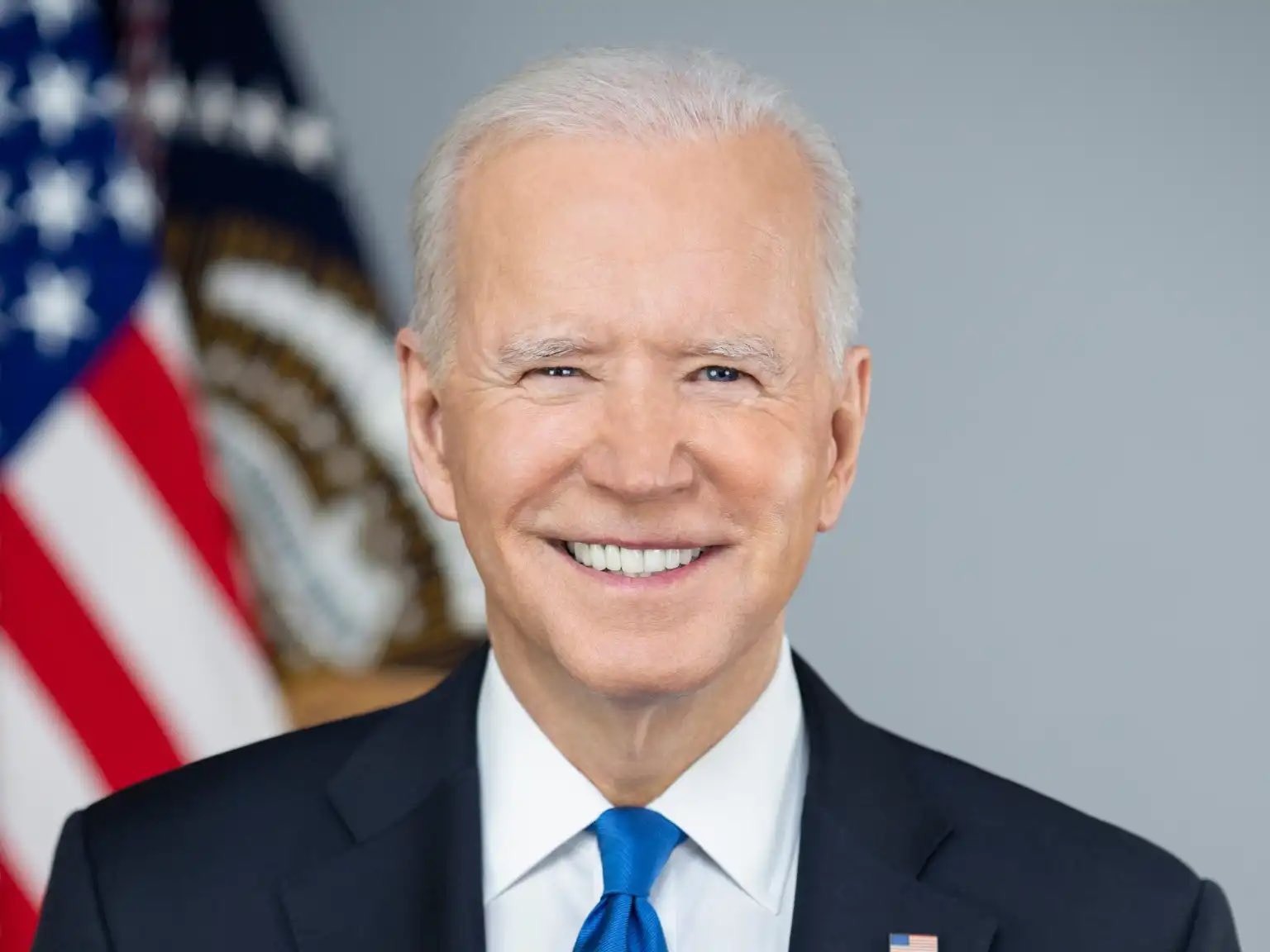

Biden proposes 25% tax (Credits: Reddit)

One of the key provisions is a 44.6% tax on capital gains, specifically targeting high-income earners with annual incomes exceeding $1 million. Additionally, a 25% tax on unrealized gains has sparked concern among stock investors, prompting some to consider selling their holdings before the law is enacted.

However, it’s essential to note that this tax would only affect individual taxpayers with over $100 million in net assets, according to a report from Grant Thornton’s tax analysts.

Biden’s tax proposal (Credits: Vox)

President Biden has emphasized that individuals earning less than $400,000 annually would not face tax hikes, ensuring that the new tax plan creates a more equitable balance between high-earning individuals from ordinary income and those from investment income.

This policy seeks to ensure that wealthier individuals contribute a fairer share relative to their substantial financial activities. Despite the merits of this proposal, its future is uncertain. The Republican Party, which controls the House of Representatives, has historically been conservative regarding tax and budget proposals, especially those put forward by the Democratic Party.

Consequently, President Biden, his administration, and the Democratic Party face a challenge in passing this proposal. The fate of this tax plan remains to be seen, as it navigates the complex political landscape of Washington.