China has experienced a significant decline in foreign direct investment (FDI), with inflows dropping by 11.7 percent, according to the Ministry of Commerce. Between January and July 2023, there was a $111.8 billion decrease, followed by another $11.8 billion drop from July to September.

This marks the first time such a substantial deficit has been recorded since China began keeping records in the late 1990s. The decline in FDI reflects a broader trend of decreasing foreign business engagement and investments in China over the past few years, driven primarily by factors such as the COVID-19 pandemic and China’s insular policies.

A notable shift is the sharp decline in Taiwanese investments in China, reaching their lowest level in 20 years. In 2023, only 11 percent of Taiwan’s total outbound investment went to China, down from 34 percent the previous year.

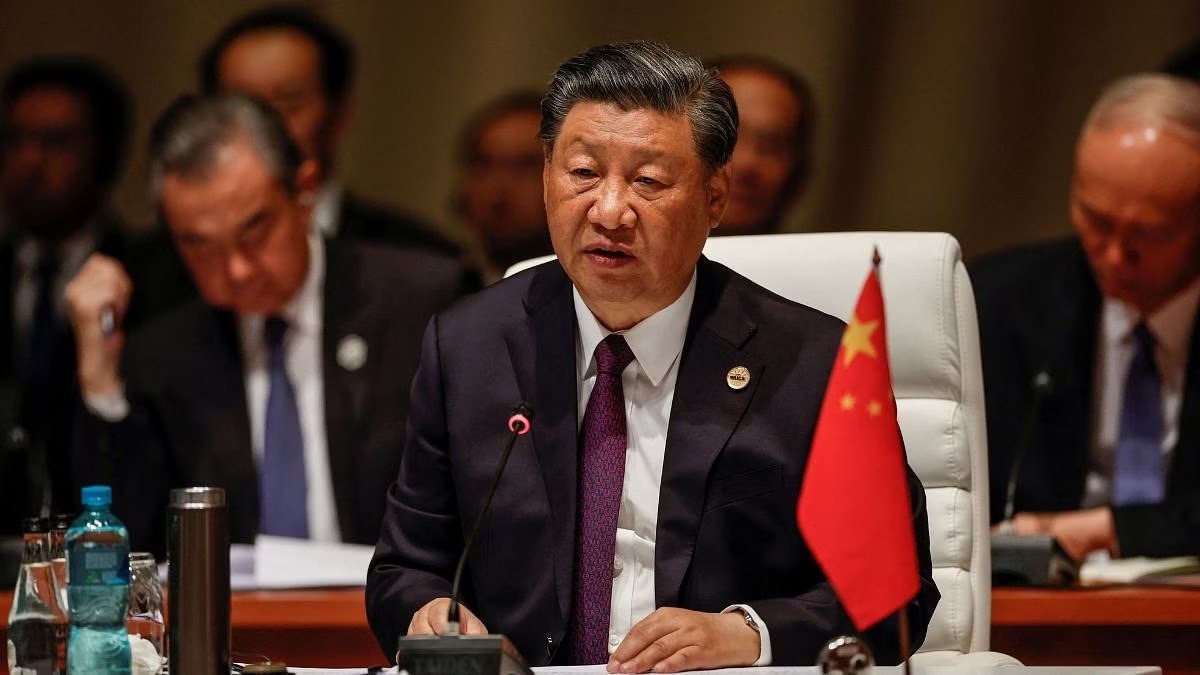

China On Low Foreign Direct Investment (Credits: ThePrint)

Taiwan is now redirecting a significant portion of its outbound investments toward South Asia, mainly India, and Southeast Asia.

This shift is attributed to strained cross-strait relations, China’s use of trade as a weapon, frequent economic coercion tactics, and Taiwan’s implementation of the New Southbound Policy to diversify its economic links.

Despite these challenges, the situation does not indicate a doomsday scenario for China. Beijing remains the world’s second-largest FDI recipient after the US.

However, the declining investments signal a slowdown in China’s economy and the additional challenge of foreign businesses relocating elsewhere.