President Biden has ignited a tax battle with the Republican Party by proposing tax hikes on wealthy individuals and big businesses ahead of a potential rematch with former President Trump.

In his budget proposal, Biden called for a wealth tax on individuals worth more than $100 million and restoring the corporate income tax rate to its pre-Trump level.

While Biden’s tax plans are unlikely to pass a divided Congress, they highlight the contrast between his agenda and the Republican effort to solidify Trump-era tax cuts. The expiration of several provisions of the Jobs and Tax Cuts Act of 2017 next year sets the stage for a major tax debate in 2025, regardless of the election outcome.

GOP Members (Credits: The New Yorker)

Biden’s proposal includes a 25 percent minimum tax rate on the wealthiest Americans, a restoration of the top income tax rate for those making over $400,000 a year, and raising the corporate tax rate to 28 percent. He also aims to increase the corporate minimum alternative tax from 15 percent to 21 percent.

Republicans, however, have criticized Biden’s plan, with Rep. Jason Smith (R-Mo.) calling it “the largest tax increase in the history of our country.” They advocate for an extension of Trump’s 2017 tax cuts, arguing that they spurred economic growth and wage increases.

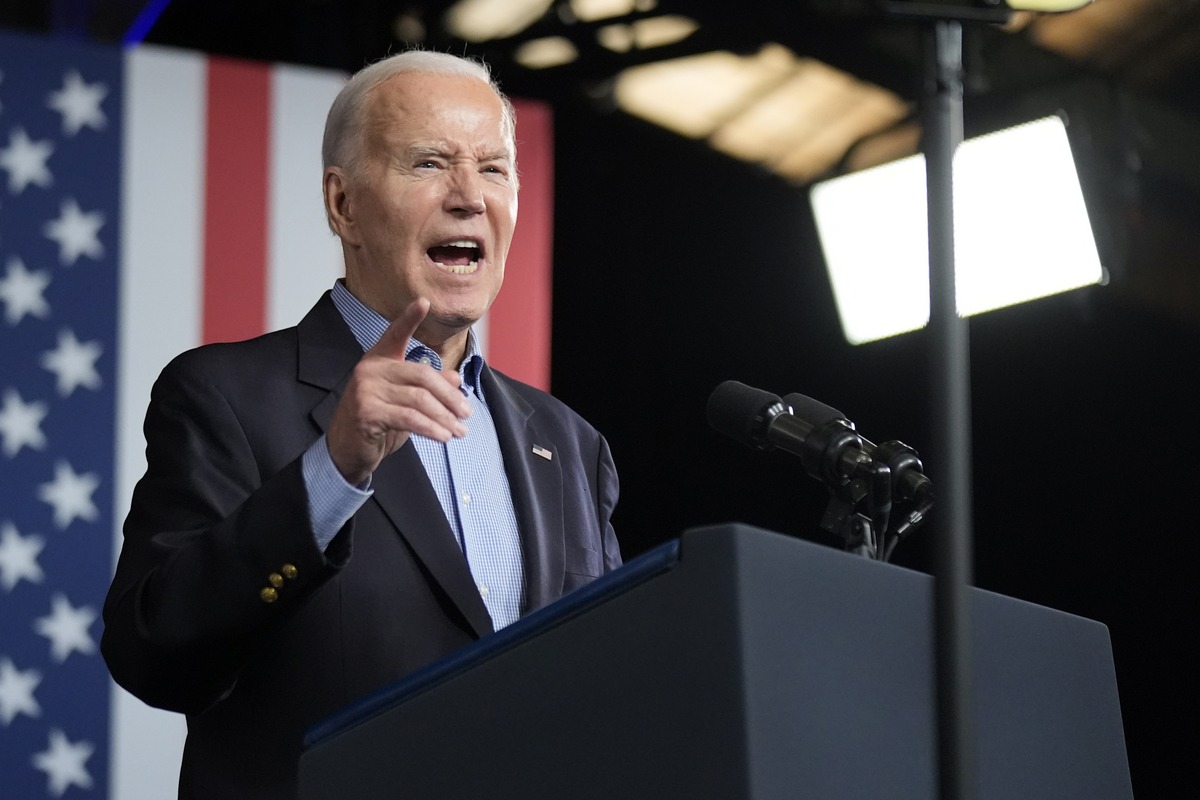

Biden (Credits: E&E News)

Trump, who is likely to secure the GOP nomination, has promised further tax cuts if reelected. Both candidates are leaning into their own brand of populism, with Trump supporting lower corporate taxes and looser financial rules, while Biden takes a more aggressive stance against big businesses and the wealthy.

As the election approaches, both parties are emphasizing their economic policies to appeal to voters. Biden’s proposals aim to address income inequality and corporate tax loopholes, presenting a clear contrast to the Republican stance.

The outcome of the election will determine the direction of tax policy in the coming years, with populism playing a significant role in shaping the debate.