Jeff Bezos ranked as the world’s second-wealthiest individual with a staggering net worth of $203.7 billion, has recently made significant strides in the real estate realm, particularly in Florida’s prestigious Indian Creek Island, famously dubbed as the “Billionaire Bunker.”

Bezos initiated his real estate endeavor with the acquisition of two lavish mansions, amounting to a whopping $147 million. Demonstrating his appetite for upscale properties, Bezos further expanded his portfolio by adding a third residence, fetching a hefty price tag of $90 million.

The latest addition to Bezos’s collection boasts six bedrooms and nine bathrooms, secured through an exclusive off-market transaction. Property records reveal its last sale in 1998, fetching a mere $2.5 million under the ownership of banker Javier Holtz.

Despite the opulence exuded by the property, Zillow’s valuation stands at approximately $41 million, marking a substantial disparity from Bezos’s agreed purchase price. This divergence underscores the premium attributed by Bezos, possibly due to its prime location, exclusivity, or potential as a bespoke home site, surpassing its estimated market value.

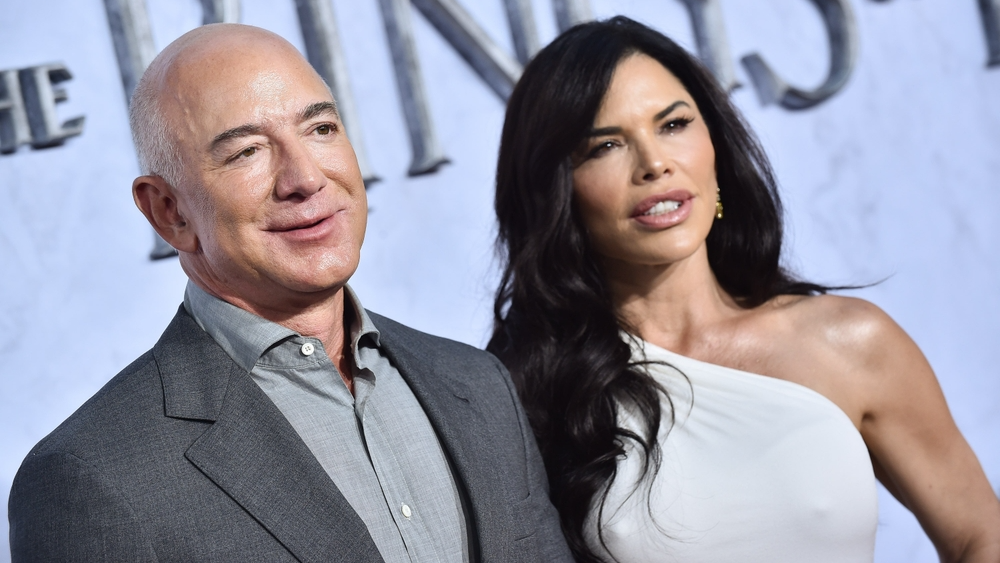

Jeff Bezos (Credits: Business Insider)

Miami is poised to supersede New York as the United States’ financial epicenter, presenting lucrative investment opportunities in the city with a nominal starting capital as low as $500, preluding this inevitable shift.

Positioned adjacent to the residences of Ivanka Trump, Jared Kushner, and NFL luminary Tom Brady, Bezos’s recent acquisitions nestle within one of America’s most affluent neighborhoods, Indian Creek. This enclave comprises a mere 80 opulent dwellings, each nestled within expansive estates, offering residents exclusive amenities, including a private golf course and country club, epitomizing a lifestyle of opulence.

Recent reports from Bloomberg hint at Bezos’s ambitious scheme to raze the initial two properties to erect a colossal mansion. However, this plan awaits official confirmation from Bezos himself.

Beyond the realm of luxury real estate, Bezos’s relocation to Florida underscores strategic acumen, coinciding with his divestment of approximately $8.5 billion worth of Amazon shares. Florida’s favorable tax landscape, characterized by the absence of state income tax, presents a substantial tax advantage, particularly for high-net-worth individuals managing substantial transactions like Bezos.

Bezos’s latest real estate endeavors, alongside his decision to liquidate Amazon stock, usher in a new chapter, intertwining personal aspirations with a Floridian transition, leveraging the state’s advantageous tax regime. His migration to Miami, fostering proximity to family and his aerospace venture Blue Origin, reflects a convergence of personal, professional, and tax-related motives underpinning the move.

While Bezos’s real estate ventures may seem beyond the reach of the average individual, entry into the real estate arena necessitates not millions but minimal initial investments.

Through Bezos-backed enterprises, real estate investment trusts (REITs), or crowdfunding platforms, opportunities abound to engage in real estate with as little as $100. These avenues democratize access to the traditionally high-barrier real estate industry, offering a pathway for nearly anyone to participate in property investment, regardless of financial stature.