A Detailed Look at U.S. Recorded Music Industry Revenue: 2021-2023

In late 2023, the RIAA (Recording Industry Association of America) reported a significant milestone in the U.S. recorded music industry, with revenue reaching $17.1 billion, marking the highest figure reported in its annual report to date. However, to understand the true significance of this number, it’s essential to examine how it compares to previous years when adjusted for inflation.

Alongside this notable achievement, the RIAA highlighted the continuous growth of vinyl sales, spanning 17 consecutive years, and emphasized the significant contribution of streaming, which accounted for a substantial 84 percent of U.S. recorded revenue in 2023.

Moreover, the RIAA pointed out that the $17.1 billion revenue in 2023, up from $15.9 billion in 2022 based on estimated retail value, marked the eighth consecutive year of growth in the domestic market.

Despite the expansions in streaming services and the resurgence of vinyl records, the industry’s revenue remains below its historical peak. To illustrate this, the RIAA’s database provides insights into the inflation-adjusted recording revenue, offering a comprehensive view of the current state of the U.S. music industry.

U.S. Music Industry Made Over $17 Billion in 2023 — How Does That Compare After Factoring in Inflation? (Credits: Digital Music News)

The table below showcases the U.S. Recorded Music Industry Annual Revenue for selected years from 1988 to 2023, adjusted for inflation in 2023 dollars, and based on the RIAA’s estimated retail value calculations:

- 1988: $16.1 billion

- 1993: $21.2 billion

- 1998: $25.6 billion

- 2003: $19.6 billion

- 2008: $12.4 billion

- 2013: $9.2 billion

- 2018: $11.8 billion

- 2023: $17.1 billion

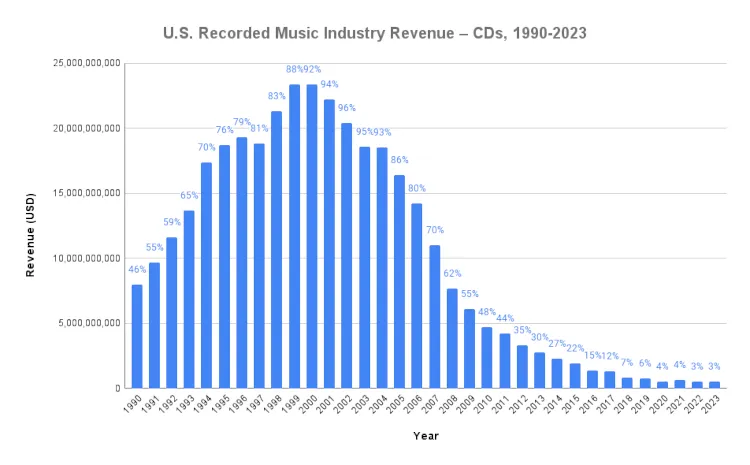

It is worth noting that the figures reveal not only the considerable revenue gap between 2023 and the prosperous years of the 1990s but also shed light on the performance of various formats and segments within the industry. While CDs dominated the market throughout the 1980s and 1990s, accounting for the majority of revenue, their share dwindled significantly by 2023, constituting only 3.1 percent of U.S. recorded revenue, as per the RIAA’s data.

These statistics primarily focus on the U.S. recorded market, but similar insights can likely be drawn from inflation-adjusted analyses of other music sectors. Globally, various countries have demonstrated noteworthy trends in their music industries.

For instance, Australia experienced double-digit growth, Italy saw an 18.8 percent revenue spike from 2022, the U.K. witnessed nearly 19 percent growth in vinyl sales, Germany reported a 12 percent increase in streaming volume with cumulative on-demand streams surpassing one trillion, and France recorded a 6.2 percent revenue increase, marking seven consecutive years of growth.