The economy seems to be bouncing back post-pandemic, with experts like Paul Krugman and Mohamed El-Erian highlighting lower inflation, improved growth, and a resilient job market.

However, this positive view isn’t widely shared on Main Street, where concerns about a looming recession persist, and layoffs by major companies are on the rise. Surveys indicate that a majority of Americans aren’t pleased with “Bidenomics,” while workers are frustrated that their wages haven’t kept up with inflation.

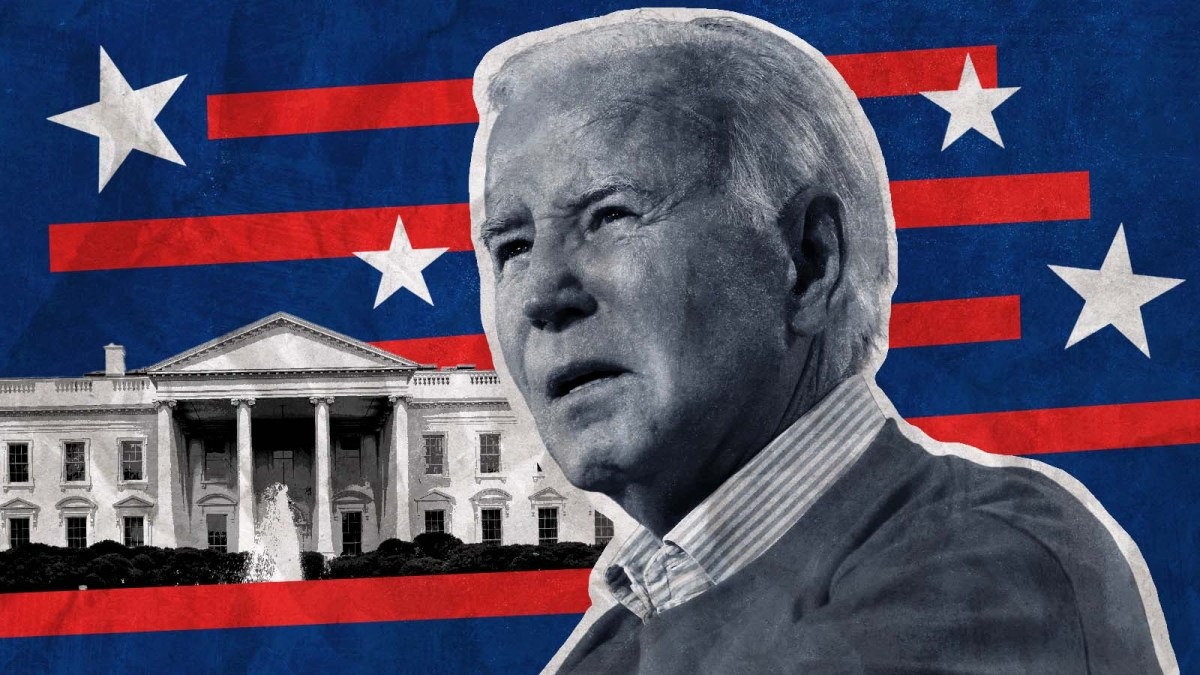

2024 US Presidential Election (Credits: Asharq Al-Awsat)

The “misery index,” a simple measure that combines inflation and unemployment rates to gauge economic health, may no longer accurately capture public sentiment toward presidents.

Developed by economist Arthur Okun in the 1970s, the index has recently dropped to about 7% under President Biden, signaling better economic conditions post-pandemic. However, this improvement doesn’t align with how people feel about the economy.

Despite the lower inflation and stable unemployment rates, Biden’s approval ratings regarding economic management remain low. This has implications for his reelection chances, with polls showing Trump gaining a slight lead and Biden’s odds estimated at around 45% for November’s election.

US Elections (Credits: International IDEA)

Economists like Larry Summers argue that the misery index is outdated because it doesn’t factor in interest rates. The Federal Reserve‘s actions to curb inflation by increasing interest rates have led to higher borrowing costs, affecting mortgage and credit card payments. This, in turn, has contributed to public dissatisfaction with the current economic situation.

Biden will need to change public perceptions about the economy to secure reelection. This involves addressing concerns about rising costs and stagnant wages affecting everyday Americans.

At the same time, the credibility of economic indicators like the misery index is under scrutiny, given the changing financial landscape and the disconnect between economic data and public sentiment.