Stephen Moore, a visiting fellow at the Heritage Foundation and senior economic advisor to Donald Trump, criticizes President Joe Biden’s approach to corporate taxes, mainly targeting green energy firms.

Moore argues that while Biden urges corporate America to “pay your fair share” of taxes, the real tax dodgers are not Big Tech or Wall Street but rather the renewable energy sector.

According to Moore, green energy companies often pay minimal to no income taxes despite receiving substantial federal subsidies. These subsidies, amounting to over a quarter trillion dollars in the past two decades, were meant to support what was initially considered an emerging industry.

However, Moore argues that these companies have not lived up to their promises, as wind and solar power still represent a small fraction of America’s energy production.

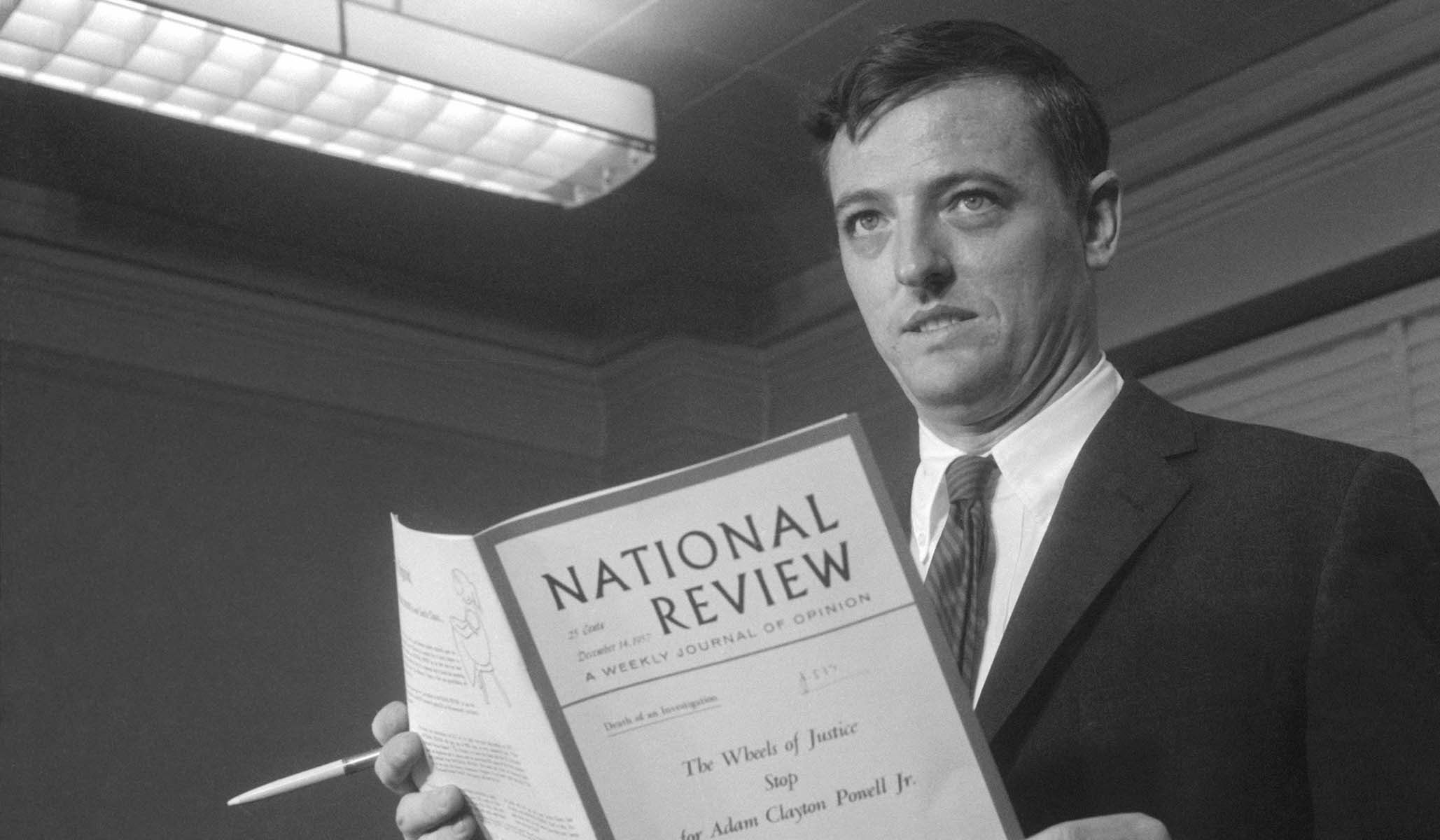

William F. Buckley Jr. (Credits: PBS)

Moore criticizes Biden’s policies, such as the Inflation Reduction Act (IRA), for further subsidizing the green energy industry at taxpayers’ expense. He highlights a report by tax expert Adam Michel at the Cato Institute, which estimates that these subsidies could drain the Treasury of up to $1.8 trillion over a decade.

Despite advocating for a minimum 15% corporate tax rate, Biden’s exemption of the green energy sector from this minimum is seen by Moore as contradictory.

He suggests that the green energy lobby benefits in a huge manner from climate change concerns, enriching certain individuals while not greatly advancing renewable energy adoption.

The Incomparable Mr. Buckley (Credits: WHRO)

In Moore’s view, the emphasis on “green” in green energy is more about financial gains than environmental benefits. Given the limited progress in reducing reliance on fossil fuels and nuclear power, he questions the effectiveness of the substantial taxpayer-funded support for the industry.

On a last note, Moore presents a skeptical view of the green energy sector’s tax practices and its impact on both the economy and the environment.