President Joe Biden’s recent announcement of a program targeting the student loan debt of 25 million borrowers, encompassing both undergraduate and graduate loans, marks a step in addressing a longstanding issue affecting millions of Americans.

This initiative is designed to provide substantial relief. Approximately 10 million borrowers are expected to receive a minimum of $5,000 in debt reduction, and over four million borrowers are set to have their debts forgiven entirely.

Biden made this program known during a visit to Madison, Wisconsin, emphasizing its potential to alleviate financial burdens and improve economic prospects for millions of Americans.

However, the program has sparked both support and criticism from various quarters, reflecting the complex landscape of student loan policies and the broader debate on higher education affordability.

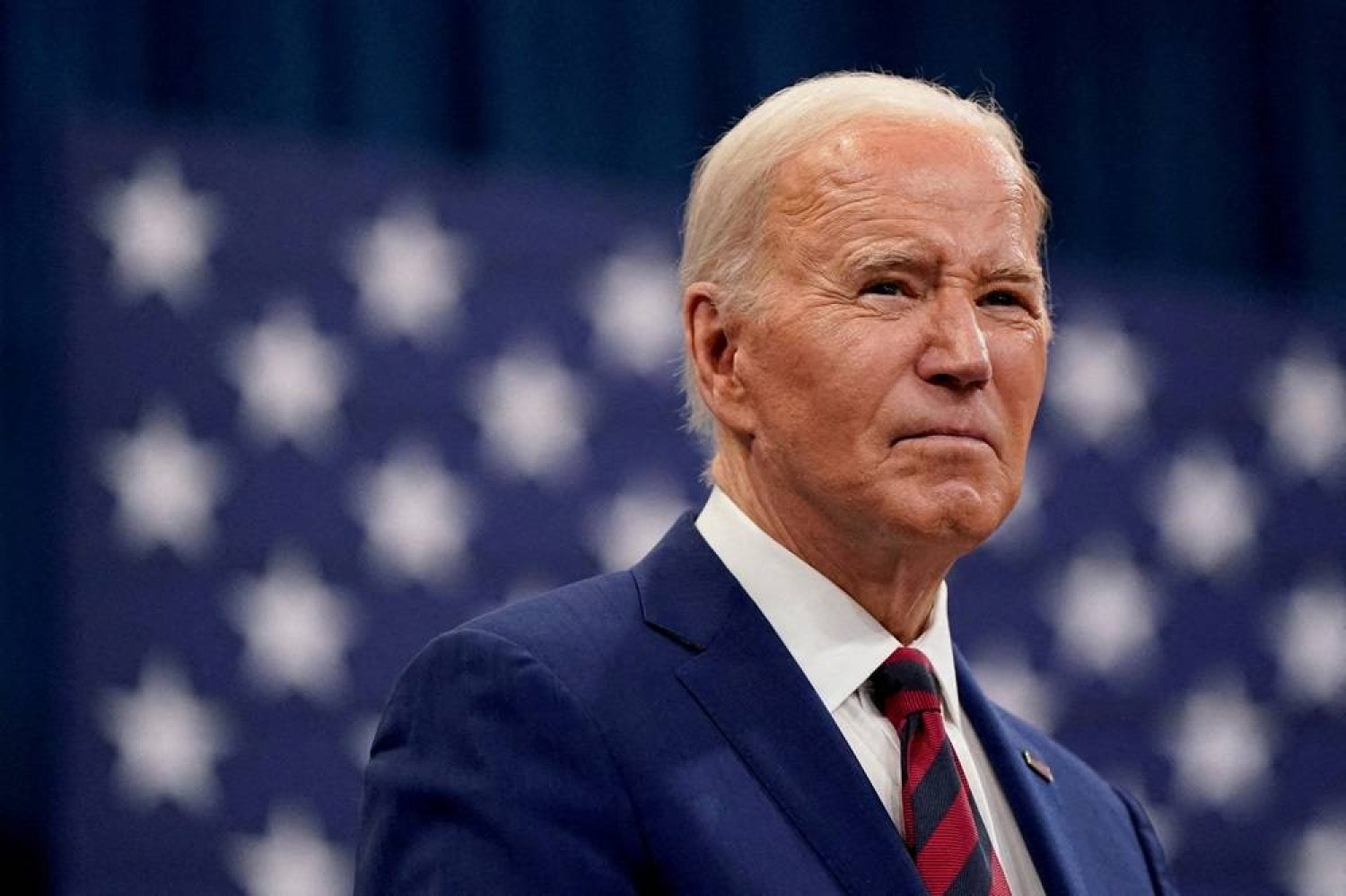

Joe Biden (Credits: Asharq Al-Awsat)

Student loan debt has been a pressing concern for many Americans, impacting individuals and families across socio-economic backgrounds. The rising costs of higher education, coupled with stagnant wage growth and economic challenges, have exacerbated this issue, leading to a financial strain on borrowers.

According to data from the Federal Reserve, student loan debt in the United States has reached unprecedented levels, surpassing $1.7 trillion. This staggering figure underscores the magnitude of the problem and the urgency of finding effective solutions to alleviate the burden on borrowers.

President Biden’s Program Overview

President Biden’s program aims to provide targeted relief to millions of borrowers facing student loan repayment challenges. The key components of the program include:

1. Debt Reduction: Approximately 10 million borrowers are expected to receive a minimum of $5,000 in debt reduction. This measure aims to provide immediate relief to borrowers struggling with high levels of student loan debt, particularly those with lower incomes or facing financial hardship.

2. Debt Forgiveness: Over four million borrowers will have their student loan debts forgiven entirely. This aspect of the program acknowledges the financial challenges specific segments of borrowers face and seeks to provide a path to debt relief and economic stability.

3. Impact on Borrowers: Implementing the program would have a tangible impact on borrowers’ financial situations, reducing monthly payments for many individuals and families and potentially freeing up resources for other essential expenses.

4. Legislative and Administrative Considerations: While the program represents a proactive approach to addressing student loan debt, its legality and potential for reversal by future legislative or administrative actions have been subjects of debate and scrutiny.

Support and Criticism

The program has received mixed reactions from various stakeholders, reflecting divergent perspectives on student loan policies and government intervention in higher education:

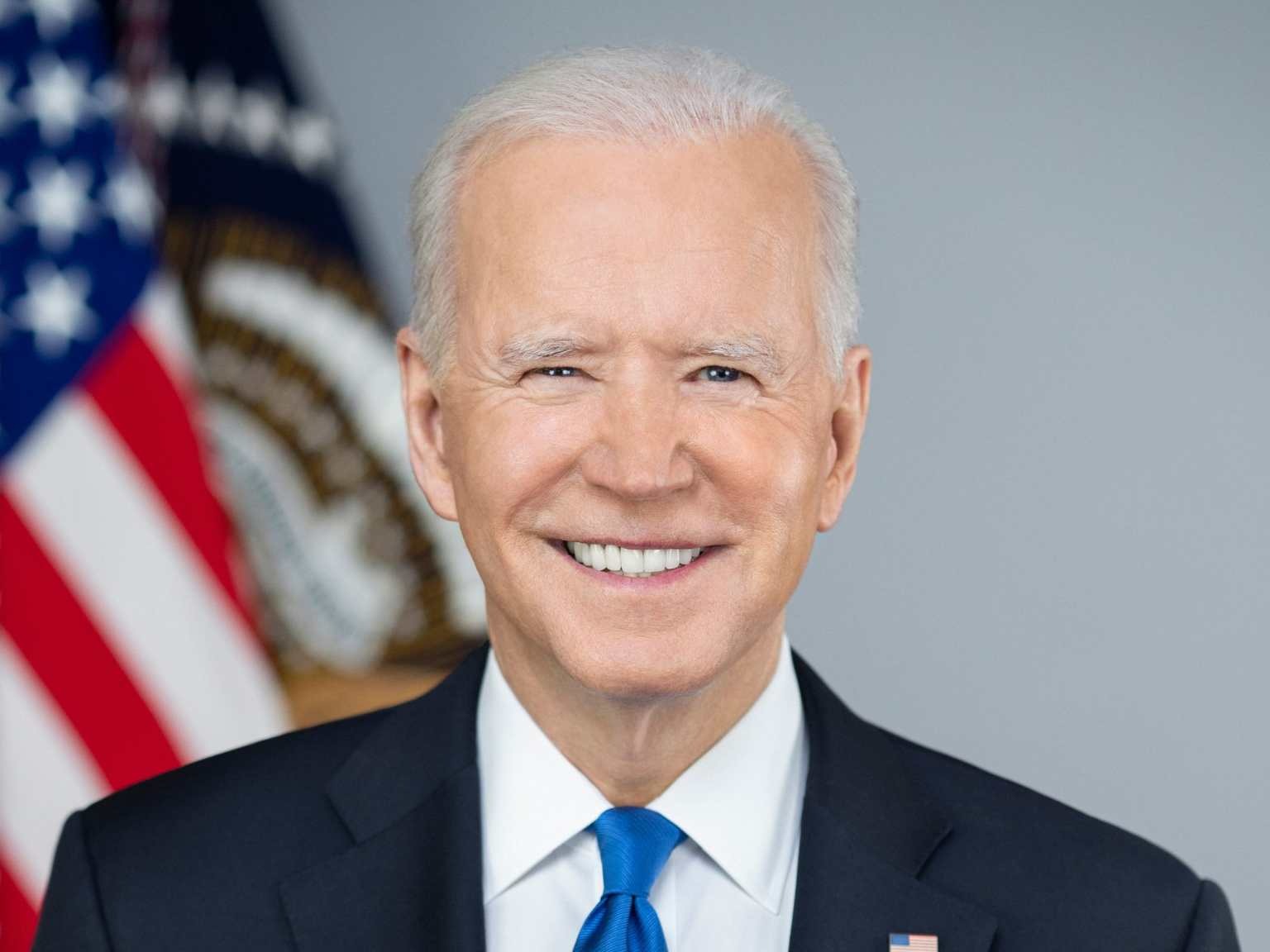

Joe Biden (Credits: The White House)

1. Supporters: Advocates for student loan relief applaud President Biden’s program as a much-needed step toward easing the financial burden on millions of borrowers. They argue that reducing student loan debt can stimulate economic activity, improve financial well-being, and promote social mobility.

2. Critics: Critics of the program raise concerns about its potential costs, funding mechanisms, and long-term implications. Some argue that widespread debt forgiveness may have unintended consequences, such as moral hazard or distortions in the higher education market.

3. Policy Considerations: The program’s design and implementation also raise important policy considerations, including equity, accountability, and sustainability. Balancing the need for relief with fiscal responsibility and fairness to taxpayers is a complex challenge that policymakers must change.

Looking Ahead

As President Biden’s student loan relief program moves forward, several key factors will shape its impact and effectiveness:

1. Legislative Approval: The program’s success hinges on legislative approval and support, highlighting the importance of bipartisan cooperation and consensus-building in addressing student loan debt.

2. Implementation Challenges:** Implementing a large-scale student loan relief program entails logistical and administrative challenges, including eligibility verification, fund allocation, and coordination with loan servicers.

3. Economic Implications: Economists and policymakers will closely monitor and analyze the program’s economic implications, including its effects on consumer spending, loan markets, and higher education affordability.

4. Debt Relief Strategies: Beyond immediate relief measures, policymakers and stakeholders will continue to explore innovative debt relief strategies, such as income-based repayment plans, loan forgiveness programs tied to public service, and reforms to the student loan system.

President Biden’s student loan relief program represents a giant effort to address a critical issue affecting millions of Americans. While the program has elicited diverse reactions and raised important policy considerations, its ultimate impact will depend on effective implementation, legislative support, and ongoing evaluation of its economic and social consequences.

As the debate on higher education affordability and student loan policies continues, finding sustainable and equitable solutions remains a shared goal for policymakers, educators, and advocates across the United States.