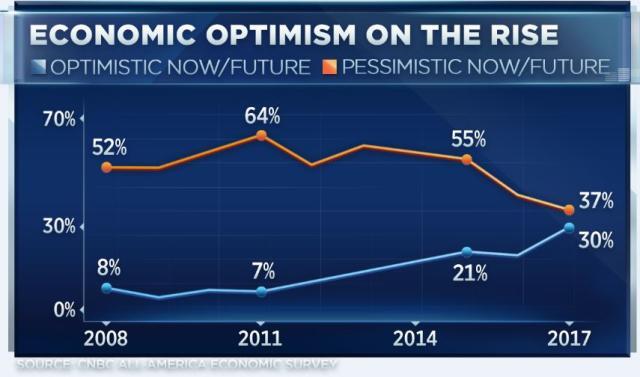

American consumers are experiencing a renewed sense of optimism about the economy, marking a potential end to the period some referred to as a “vibes-cession.” Despite historically low unemployment and decreasing inflation, there had been a lingering feeling of unease.

The University of Michigan’s monthly survey on U.S. consumer sentiment witnessed a remarkable 13% surge in January, reaching its highest level since July 2021. The two-month cumulative gain of 29% is the most substantial consecutive increase since 1991, signaling the end of a recession. Additionally, the New York Federal Reserve’s December survey on consumer finances showed an improvement in perceptions of households’ current financial situations.

Americans Regain Economic Optimism, With Certain Exceptions Persisting (Credits: Yahoo)

Perceptions of the economy continue to be divided along political lines, with Democrats rating their economic conditions significantly higher than Republicans in the University of Michigan survey. Despite this, the overall economy rating, at 78.8, remains below pre-pandemic levels. However, sentiment is now just 7% below the historical average of 1978.

Analysts view the upward trend in sentiment as unmistakable, attributing it to the robust labor market and easing concerns about inflation. The Department of Labor reported a drop in weekly initial unemployment claims to 187,000, the lowest level since September 2022, with the unemployment rate at 3.7%, matching pre-pandemic levels.

The New York Fed’s survey indicates that this strength is likely to persist, with a decrease in the mean probability of the U.S. unemployment rate increasing in the next year. Additionally, perceived job loss probability decreased.

In terms of inflation, the Bureau of Labor Statistics reported a continued slowdown in price growth. U.S. consumers’ expectations align with this trend, with median inflation expectations for the next 12 months at their lowest since January 2021.

Despite positive indicators, certain aspects of the economy remain changed or worse off than pre-pandemic. Prices, though slowing, are still elevated compared to 2019 levels. Ongoing inflation has been fueled by a significant decrease in overall labor force participation, contributing to higher wages and increased prices.

Notably, the New York Fed’s survey reveals disparities in economic views based on demographics. Earnings expectations declined, particularly among individuals with at most a high school diploma, while job insecurity surged for this group.

Political divisions play a key role in shaping opinions about the economy. Mark Zandi, chief economist at Moody’s, points out that despite varying debt service levels, the overall sentiment reflects an unusually positive economy, marked by moderating inflation, record-high stocks, and housing prices.

In conclusion, despite some lingering challenges, the overall trajectory of the economy appears promising, evoking a sense of optimism among American consumers.