Donald Trump, the former president and current GOP front-runner, is considering a significant economic move against China if he secures re-election. This strategy, widely perceived as having the potential to initiate a global trade war, involves publicly supporting the downgrading of China’s trade status with the United States.

This action could lead to a substantial increase in tariffs between the two largest economies globally, with discussions even considering the revocation of China’s “most favored nation” trade status, possibly resulting in federal tariffs on Chinese imports exceeding 40 percent.

Privately, Trump has explored the possibility of imposing a flat 60 percent tariff on all Chinese imports, according to anonymous sources familiar with the matter. Economists from both parties caution that any of these options could cause significant disruptions to the U.S. and global economies, surpassing the impact of Trump’s initial term’s trade wars.

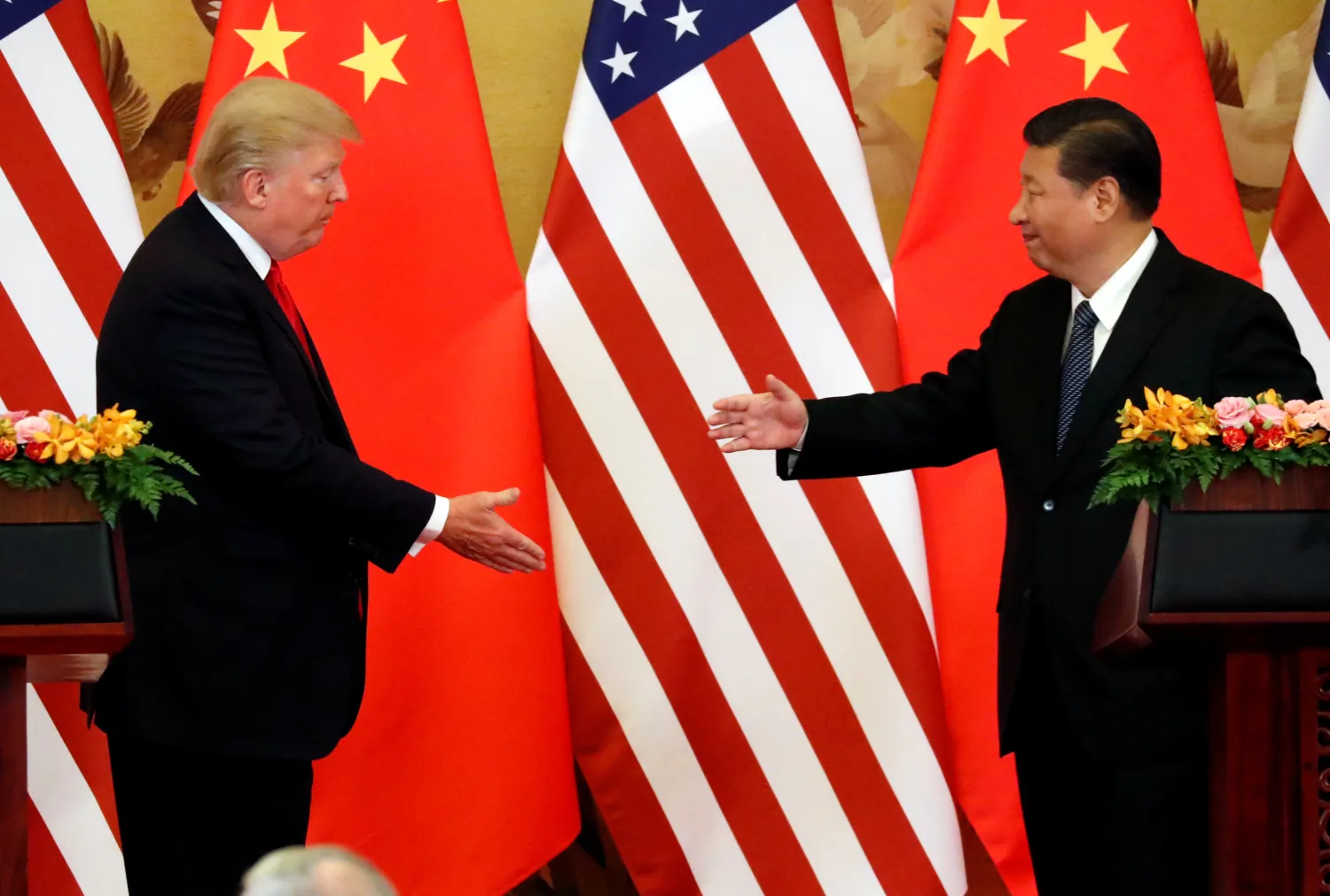

Despite having praised Chinese President Xi Jinping in the past and signing a trade deal in 2020, Trump has shifted to a more critical stance towards Beijing during his current campaign.

Trump’s escalating trade disputes with China highlight the increasing economic significance of the 2024 election, with the former president concentrating on intensifying policies from his first term.

Economists express concerns that the potential consequences of these trade measures could exceed the damage caused by the trade wars in 2018-2019. Erica York, a senior economist at the Tax Foundation, emphasizes that such actions could upend and fragment global trade to an unprecedented extent.

While President Biden has maintained many of the tariffs imposed by Trump in 2018, Trump is pledging to take further steps. He argues that tariffs on imports support domestic industries and generate revenue for the federal government.

However, economists warn that such tariffs increase costs for U.S. consumers and producers. Trump’s plans include enacting a “universal baseline tariff” on nearly all imports, representing more than a ninefold increase compared to his first term.

Trump’s focus on China is particularly notable, as he considers his tariffs on the country a key achievement of his initial term. China, the third-largest U.S. trading partner, accounts for a significant portion of total U.S. foreign trade. Critics argue that the costs of the trade war were primarily borne by U.S. consumers and firms rather than China’s government.

Prominent economists and experts, such as Adam Posen of the Peterson Institute for International Economics, criticize Trump’s trade proposals as “lunacy.” They argue that a crackdown on Chinese imports would harm U.S. firms by potentially cutting them off from billions of customers.

The potential consequences of a renewed trade war with China include substantial economic costs and job losses, according to a report commissioned by the U.S.-China Business Council.

While Trump and his supporters view tariffs as a strategic tool to address deceptive trade practices, critics argue that such measures could undermine U.S. firms by limiting their market share in China and other countries. The debate over tariffs and their impact on the economy remains a central point of contention in the broader economic and political landscape.