After nearly two years of delays, the merger between the SPAC Digital World (DWAC) and the Trump Media and Technology Group (TMTG), which controls the Truth Social platform, is finally moving forward. Despite being held up due to various reasons, including federal investigations, the merger is now set to proceed.

Digital World is gearing up to announce a special meeting of its shareholders to officially approve the proposed business combination with TMTG.

The meeting is scheduled for March 22, 2024, at 10:00 a.m. Eastern Time, with the record date for the meeting set as February 14, 2024. Shareholders can access the live webcast of the meeting at https://www.virtualshareholdermeeting.com/DWAC2024SM.

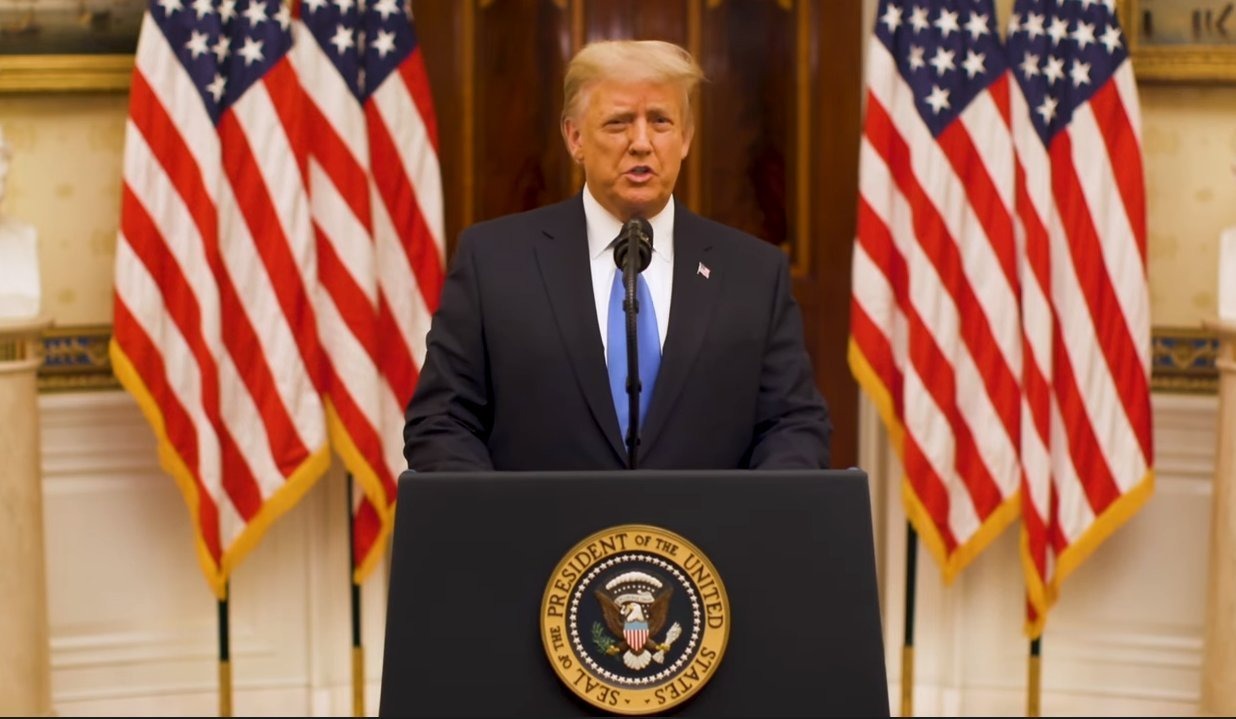

Trump (Credits: Reuters)

Upon approval, the shares of the merged entity will be listed on the Nasdaq index. Former President Trump will own 78.75 million shares of the combined company, making him the largest beneficiary.

In preparation for the merger, Digital World has been improving its financial position. It issued promissory notes worth $50 million last week to increase its liquidity.

These notes offer an annual interest rate of 8 percent and can be converted into equity under certain conditions. Additionally, Digital World is expected to receive around $35 million from the sale of warrants to institutional investors.

To ensure that TMTG continues to adhere to the merger agreement, Digital World has announced $6.38 million in cumulative cash bonuses to attract and retain employees and personnel associated with TMTG. They are also offering 40 million additional earnout shares.

TMTG faced cash constraints when it could not close its merger agreement with Digital World. However, with the SPAC raising around $293 million through an IPO, TMTG will have access to these funds once the merger is completed. As of September 2023, Truth Social had $1.8 million in cash against total liabilities of $60.5 million.