According to federal data released Thursday, inflation and personal incomes rose in January, another sign of economic strength that could delay long-anticipated interest rate cuts.

The personal consumption expenditures (PCE) price index, the Federal Reserve’s preferred inflation gauge, rose 0.3 percent in January and 2.4 percent over the past 12 months.

Monthly inflation picked up slightly from December, when the PCE index rose 0.1 percent, even as the annual inflation rate fell from 2.6 percent in the final month of 2023.

US inflation (Credits: ShareCafe)

Inflation without volatile food and energy prices, known as “core” inflation, rose to a 0.4 percent gain in January after rising 0.2 percent in December. Annual core inflation fell to 2.8 percent last month from 2.9 percent in December.

The slight increase in inflation came in line with economists’ expectations following a solid January jobs report and hotter-than-expected consumer price index (CPI) inflation data.

However, a 1 percent January increase in personal income defied economists’ projections of a 0.4 percent rise last month, according to consensus estimates.

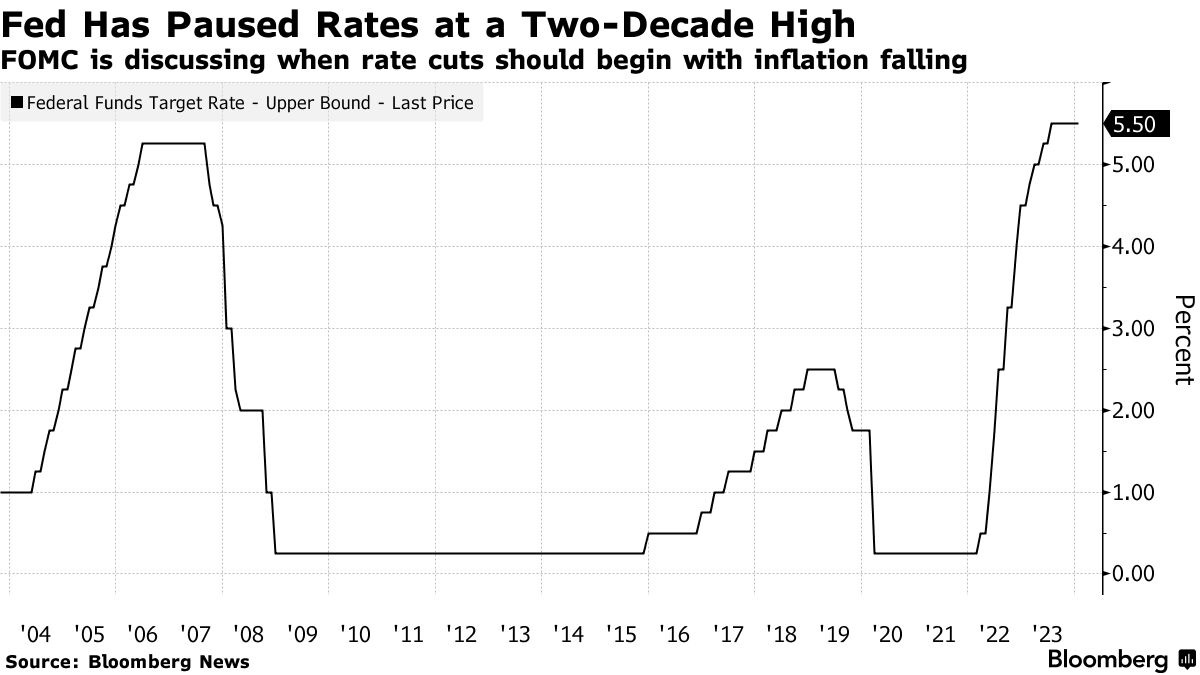

While inflation has fallen sharply from four-decade highs in 2022, it remains notably above the Fed’s annual target of 2 percent. The recent run of strong economic data will likely dissuade the Fed from cutting rates and adding more fuel to the economy.