On Saturday, Donald Trump expressed his enthusiasm for Truth Social to his extensive online following, but the recent decline in the share price of the merged company behind the social media app might not sit well with shareholders.

Digital World Acquisition Corp. (DWAC), the shell company involved in the merger, experienced a significant drop in its share price, nearly 14%, shortly after shareholders approved the merger on Friday morning. This merger was aimed at taking Trump’s social media venture public.

The decline in DWAC’s stock value, which hit a 52-week high just prior to the shareholder vote, continued as trading opened on Friday morning, with shares dropping to $44.20 per share. The closing price on Friday settled at $36.94 per share, with a slight recovery to $38.55 per share in after-hours trading, though still down by 12.7% from the opening price.

This downward trend may reflect concerns about the revenue prospects of Trump Media & Technology Group (TMTG), the entity merging with DWAC, particularly given TMTG’s reported losses of nearly $50 million in the first three financial quarters of 2023, despite generating less than $3.5 million in revenue during the same period.

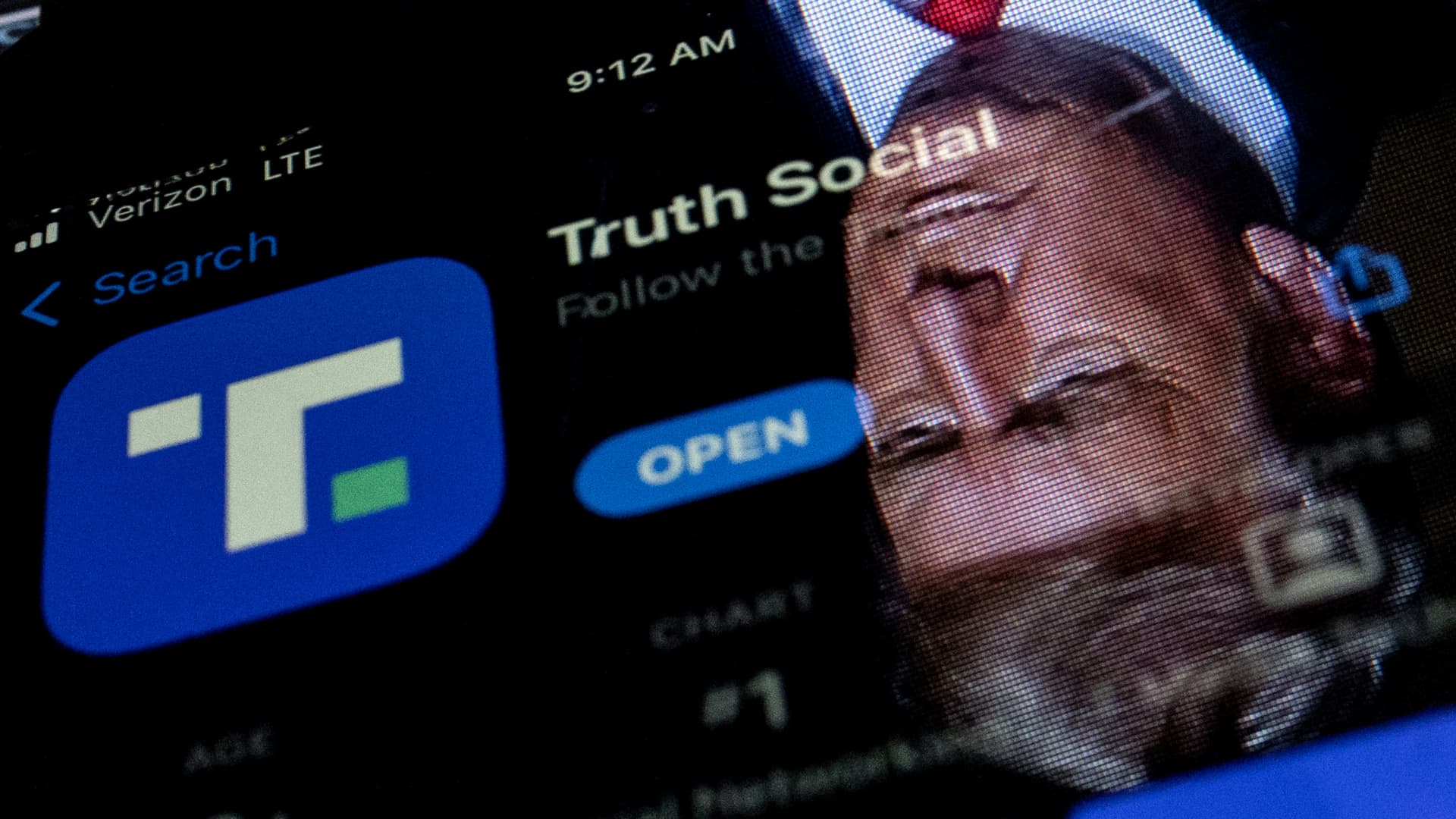

Trump (Credits: CNBC)

Meanwhile, Trump himself faces significant legal challenges, with civil judgments exceeding half a billion dollars in New York federal and state courts, along with mounting legal expenses from ongoing cases and four criminal prosecutions amidst his bid to challenge President Joe Biden in the upcoming election.

Recently, Trump’s lawyers disclosed his financial constraints in a court filing, indicating his inability to secure a $454 million appeal bond to address a fraud judgment, temporarily thwarting efforts by the New York Attorney General’s Office to collect on the award.

As per the merger terms, Trump will hold a majority stake in Trump Media, but he will be prohibited from selling shares for six months. However, the new board of directors, including his son, Donald Trump Jr., and other close associates, could vote to lift this restriction, allowing Trump to sell shares to cover legal expenses sooner. Such actions might trigger further declines in Trump Media’s share price, potentially prompting other shareholders to offload their stocks.

When Trump Media commences trading on the NASDAQ stock market, it will be identified by the ticker symbol DJT, reminiscent of Trump’s previous publicly traded venture, Trump Hotels & Casino Resorts, which faced financial challenges and eventually filed for bankruptcy protection in 2004.