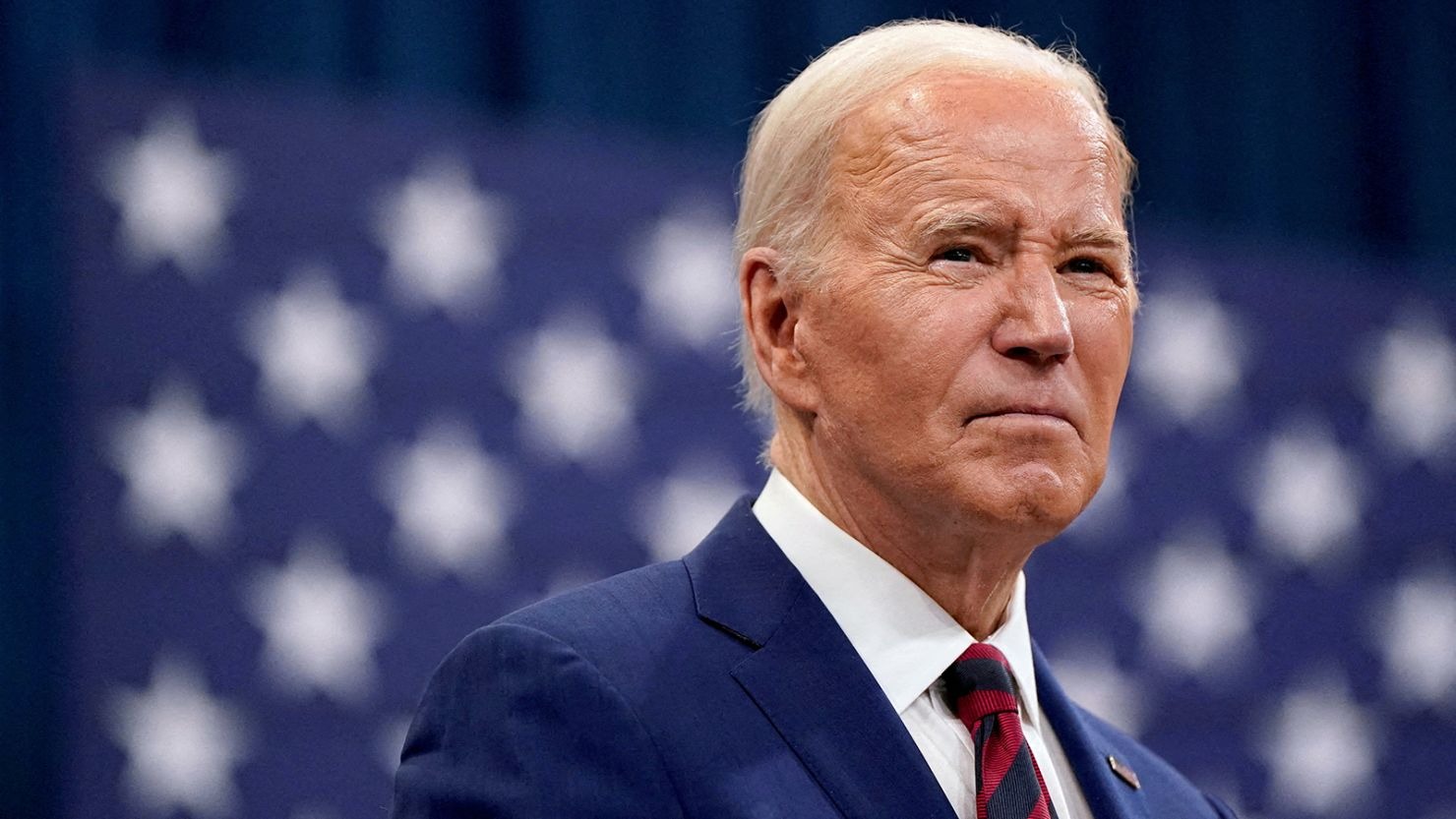

President Biden‘s portrayal of his new budget proposal emphasizes tax relief for working families, aligning with a familiar Democratic narrative of redistributing wealth from the affluent to support working and even non-working families.

However, the administration’s rhetoric surrounding tax cuts is not only exaggerated but also misleading, as it obscures substantial expansions of federal benefits.

Central to this strategy are “refundable tax credits,” a term used to describe benefit checks distributed by the IRS to adults who don’t earn enough to owe federal income taxes.

While programs like the Child Tax Credit and the Earned Income Tax Credit traditionally incentivize employment among low-income adults, the Biden administration’s portrayal of these expansions as tax cuts for those who don’t pay taxes contradicts common sense.

A closer look at the proposed expansions reveals that the majority of the costs involve new benefits for individuals who don’t pay income taxes, rather than tax cuts for taxpayers.

In fact, a staggering 83 percent of the combined cost of the proposed expansions is attributed to benefit expansions, while only 17 percent constitutes relief for taxpayers.

The administration’s rhetoric, however, focuses on tax cuts, disregarding the disproportionate emphasis on benefit increases. For instance, the Earned Income Tax Credit policy is portrayed as cutting taxes for millions, despite the fact that 88 percent of the purported tax cut actually constitutes benefit increases.

This narrative manipulation extends to legislative practices as well. For example, the House passed the “Tax Relief for American Families and Workers Act,” which included a Child Tax Credit expansion heavily skewed towards benefit hikes.

Yet, Democratic representatives framed the bill as delivering essential tax relief to working families, sidestepping the overwhelming focus on benefit expansions.

President Biden’s budget proposal follows a similar pattern, with benefit increases dwarfing actual tax relief. Despite this, the administration continues to portray these expansions as tax cuts, with some media outlets echoing this misleading narrative.

The facts belie the administration’s rhetoric, underscoring the need for a more transparent discourse surrounding fiscal policies and their implications for taxpayers and beneficiaries alike.