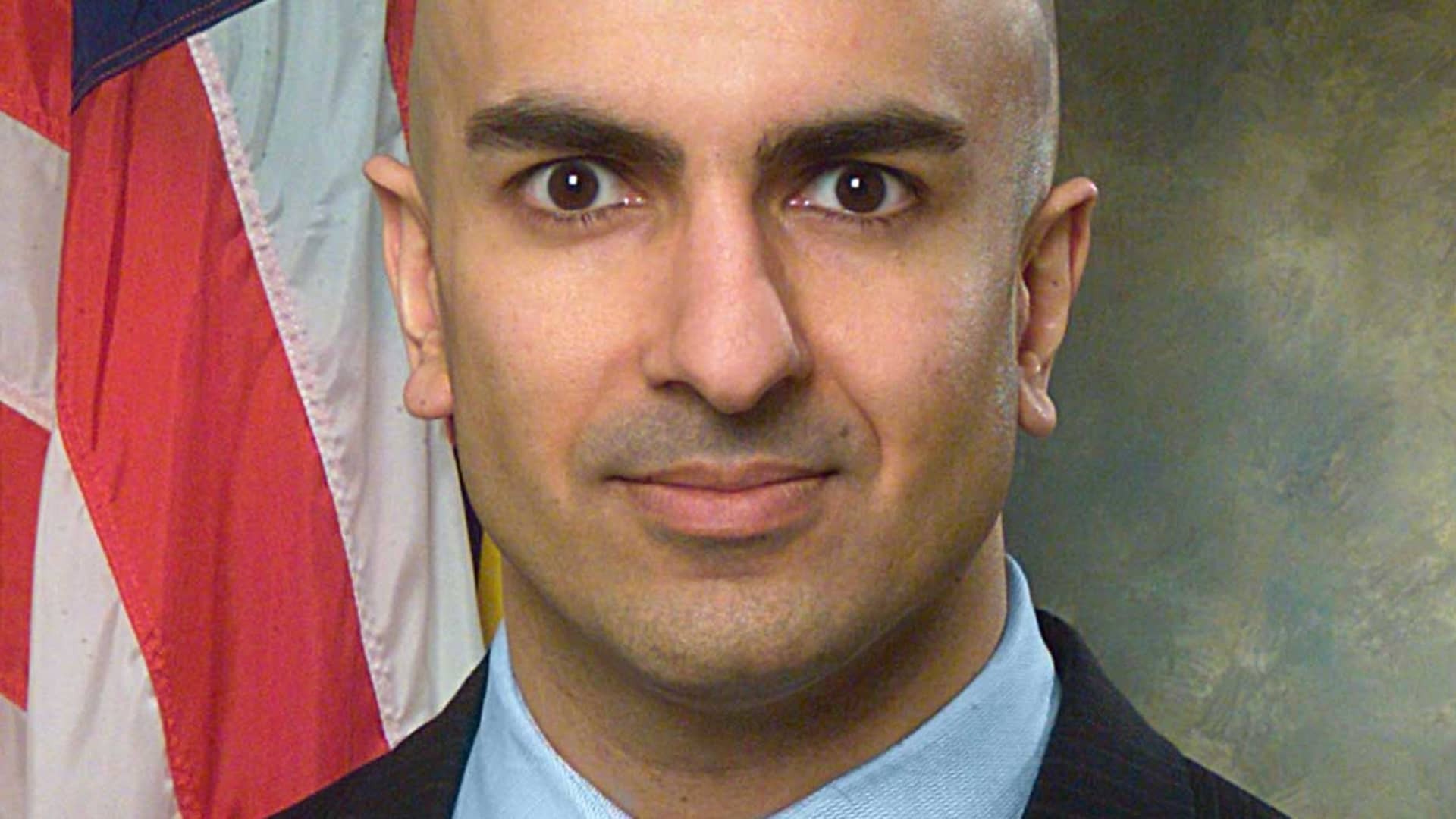

During the 2008 financial crisis, Neel Kashkari, then-Assistant Secretary of the Treasury for Financial Stability, discussed a potential trillion-dollar rescue package with Treasury Secretary Henry Paulson to support distressed corporations.

Paulson expressed concern about the political backlash, and Kashkari suggested a smaller amount, $700 billion. This conversation highlights the importance of having real-time estimates of government funding needed to assist distressed corporations during crises.

The “Estimated Debt Guarantee Expense” (EDGE) database, developed using Nobel laureate Robert Merton’s option theory insights on debt guarantee valuation, provides preemptive estimates of the cost of bringing an underwater corporation back to solvency.

The database uses 90-day Treasury yield data, total debt or deposits, market capitalization, and equity return volatility estimates as inputs. Currently spanning 1971-2022, EDGE will be updated with recent data as corporations submit quarterly SEC filings.

Analyzing over 730,000 quarterly observations, the research finds that the average estimated cost of returning all corporations to solvency is around $30 billion per quarter since 1971.

However, during crises, this estimate can surge, peaking at $983 billion in Q1 2009, $285 billion in Q1 2020, and $190 billion in Q4 1998. The findings suggest that the “Too Big to Fail” bailout problem is temporary but recurring, primarily affecting a small number of large financial and non-financial corporations.

The EDGE database reports end-of-quarter estimates, which may miss corporations that go underwater within a quarter, like Silicon Valley Bank, Signature Bank, and First Republic Bank, which failed in 2023.

However, the idea behind the database can be applied to estimate “before-the-fact” costs. Using total deposits, market value of equity, and equity return volatility inputs, the estimated ex-ante cost of guaranteeing total deposits for these banks is comparable to the FDIC’s reported ex-post estimated losses.

The method can provide a rough idea of expected losses from future bank failures, such as New York Community Bank, with an estimated ex-ante cost of $6.7 billion as of April 12.

The EDGE database aims to bring clarity to the official costs of crises in real-time. The analysis highlights that a corporation’s leverage, rather than asset volatility, drives the largest costs, supporting suggestions like John Cochrane’s proposal for minimum equity-to-asset leverage ratios for bailout candidates.