Jared Bernstein, the Chair of the White House Council of Economic Advisers, has stressed the crucial role of preserving the Federal Reserve’s independence despite former President Trump’s calls for increased presidential control over the central bank.

Bernstein highlighted a White House analysis from May, which emphasized the historical impact of maintaining an autonomous Fed. According to Bernstein, “The lessons from history are crystal clear about the damaging and long-lasting inflationary effects that can result from undermining or reversing the progress made over the past fifty years.”

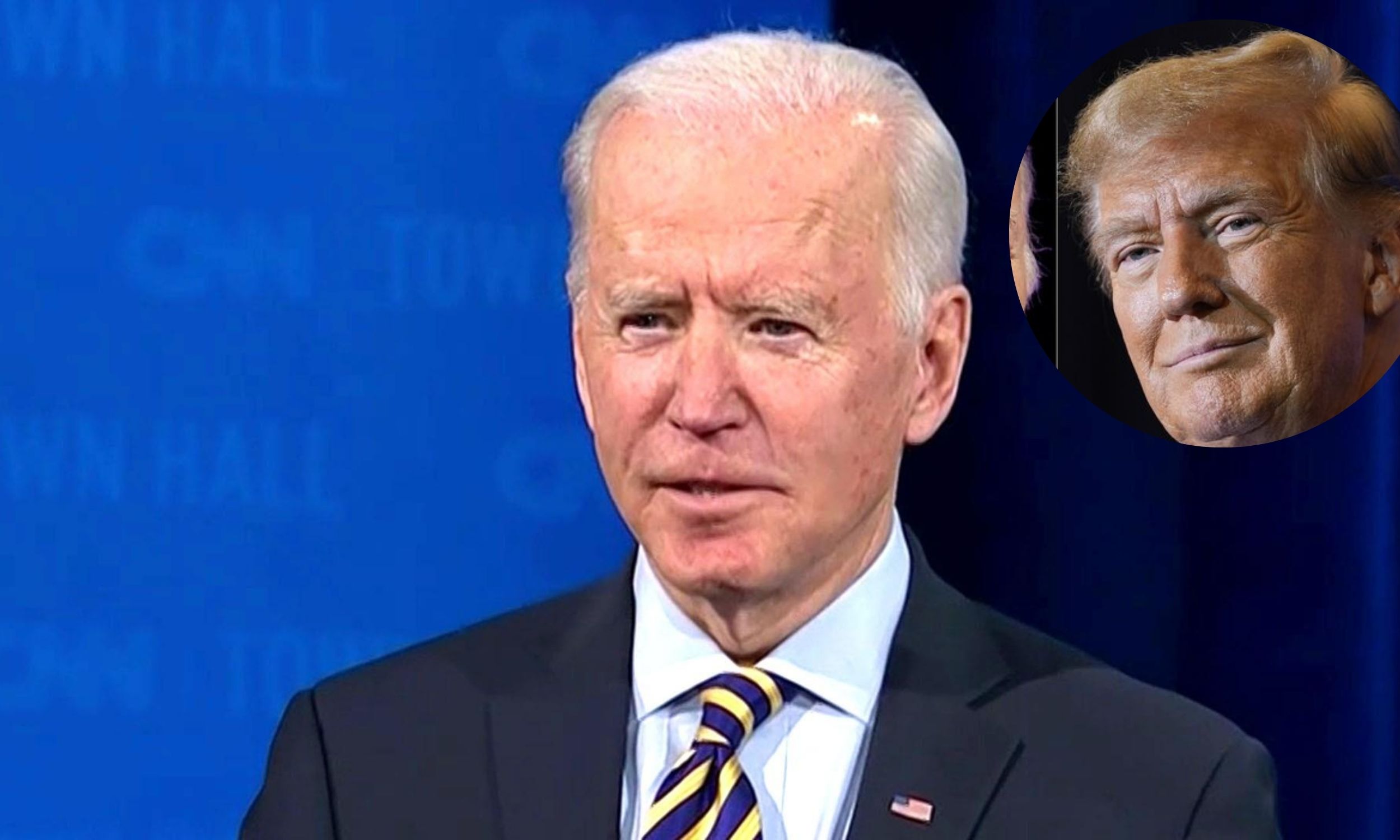

Bernstein warns of inflation risks if Federal Reserve independence is undermined, responding to Trump’s calls for influence

At a press briefing on Thursday, Trump argued vehemently that the “president should have at least some influence” over Federal Reserve decisions.

Conversely, the Biden-Harris administration has reaffirmed its stance on the necessity of a free and independent central bank, viewing it as essential for managing inflation effectively.

In April, The Wall Street Journal reported that Trump’s team had crafted proposals aimed at curtailing the Fed’s independence if he were to win the upcoming election.

Trump defended his position by asserting that his successful business background and substantial financial achievements give him a superior understanding of economic matters.

Regardless of whether Trump or Vice President Harris assumes office, the new president will select the next chair of the Federal Reserve.

Though the president nominates the Fed chair and board members, and their confirmations are handled by the Senate, these officials operate with policy independence.

Concerns have been raised that a Trump reelection might mirror former President Nixon’s 1972 efforts to pressure the Fed into adopting expansionary policies despite rising inflation.

The White House report referenced Nixon’s attempts, pointing out, “An independent central bank can be subjected to political pressure to adjust the economy for short-term political benefits, as Nixon’s pressure on Fed Chair Arthur Burns demonstrated. Yet, monetary policy’s effects develop over a more extended period.”